Evolving Risk Strategies in 2020

By Reginald Peacock and John Bang

The option of using a captive in companies’ risk management and transfer strategies is now more topical than ever in Asia Pacific (APAC). This is driven by the changing insurance market, the increasing challenges of managing today’s risks and the relatively slow evolution of the traditional insurance industry to address customers’ risk with suitable solutions. This applies to large multinational corporations and many mid-sized companies. Some experts believe the current pandemic will further accelerate these developments and eventually establish a changed environment.

At the same time, captive usage is increasingly supported by certain Asian economies (e.g. Hong Kong, Malaysia and Singapore), which have targeted regulations to facilitate captives. For instance, the Monetary Authority of Singapore (MAS) has stated that captive insurance forms an important part of Singapore’s offering as a global capital for Asian risk transfer*.

In Europe and North America, captive owners have a long tradition of addressing these challenges, using their captives to:

- Optimise insurance and reinsurance structures

- Bring two worlds (life and non-life) into one reinsurance captive

- Benefit from arbitrage opportunities in the markets (pricing, coverage and capacity)

- Strengthen the core business of the captive owner

- Develop solutions for new risks

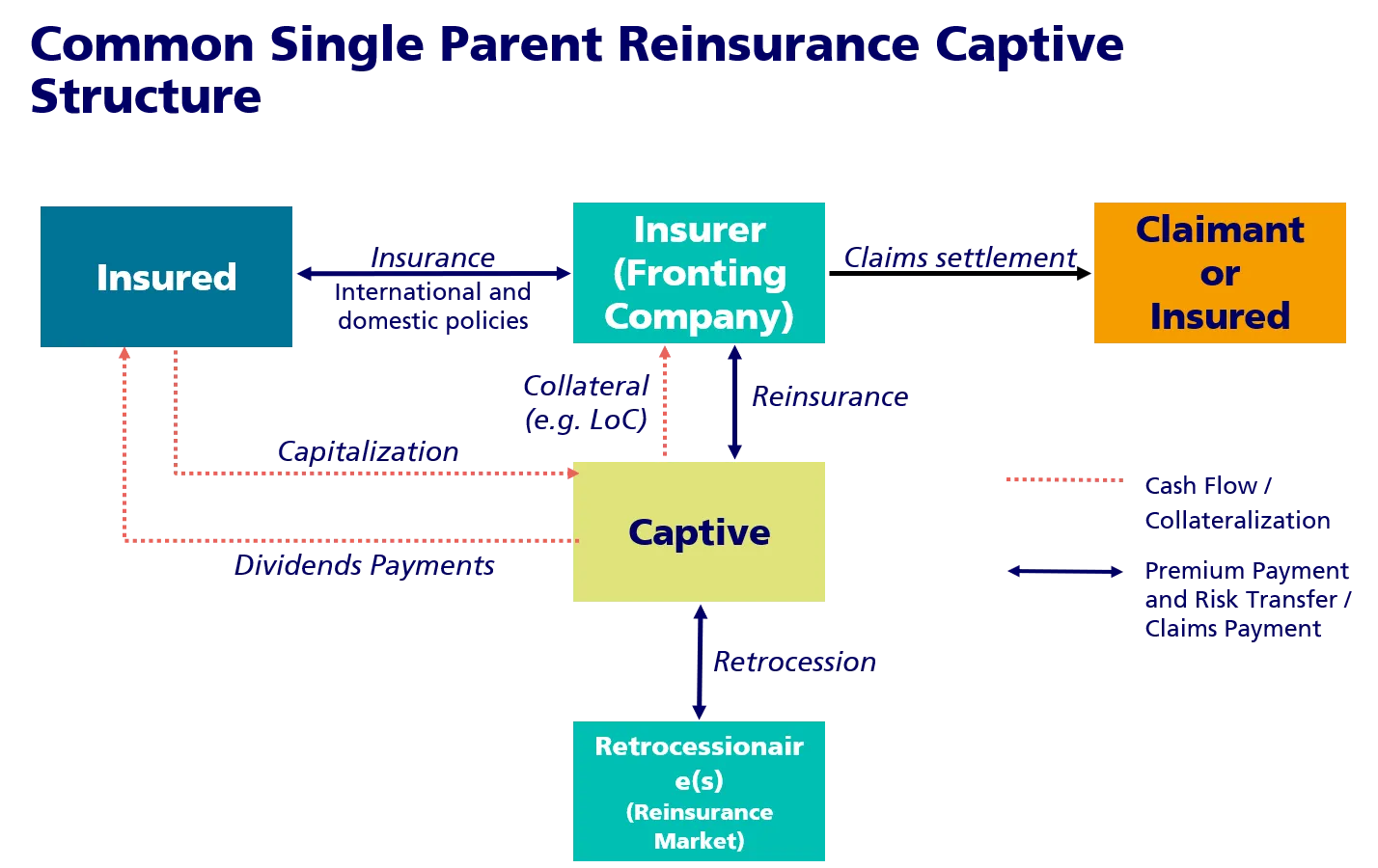

A key component in these solutions is the insurance company partner. The right partner can front and provide the underwriting, claims, risk engineering and operational infrastructure needed as well as detailed knowledge of insurance tax and regulation considerations, and efficient access to the reinsurance market (please see below chart for an overview of the most commonly-used structure, the Common Single Parent Reinsurance Captive).

The role of the insurance company partner has evolved with the way in which captives participate in their parents’ risk program. Many traditional structures focused on the primary layer of risk, aligning the interests of the customer and insurers to improve risk management – reducing the cost of risk.

Over time, captives have expanded their participation across the risk financing environment, accessing reinsurance, retrocession and Insurance-Linked Securities (ILS) markets. In these circumstances, the complexity of the insurance activities, credit risk, insurance tax, insurance regulations and the sophisticated logistical infrastructure requires a highly-resourced and capable insurance partner. The ability of the insurance partner to manage claims is particularly relevant.

Zurich Insurance is one of the few insurers with the international experience and expertise required to manage such complex captive requirements on a global scale – comprehensive support that is consistent, end-to-end, worldwide and able to:

- Simplify management across lines of business

- Solve complex insurance problems

- Access a strong and reliable global network

- Address insurance premium tax compliance for captive programs

- Provide accurate, transparent and timely bordereaux reporting through a single and centralised reinsurance clearing house concept

- Provide relevant risk insights and industry benchmarking to help optimise captive retentions

A captive can be used to maximise efficiency in an insurance programme. The Arbitrage opportunities can be categorised as follows:

- Pricing arbitrage – especially for medium and high excess layers between the insurance, reinsurance and ILS market

- Coverage and wording arbitrage – tailoring insurance programmes, for example on cyber risk, with wordings that meet the captive owner’s expectations. If it is correctly priced, the captive’s insurance coverage could be broader than that of the retrocession level behind the captive.

- Capacity arbitrage – as developed in the banking and mining industry. Such a solution generally requires substantial captive risk retention and understanding of the counterparty credit risk.

The current market environment and experience from different countries provides an opportunity for businesses in APAC to take a fresh look at their risk financing solutions.

The experience, resources and expertise of the insurance partner chosen are crucial – this is an ideal time to examine the opportunities provided by captive reinsurance solutions and initiate or deepen discussions with the right partners.

For further information, please contact:

John Bang

Captive Lead, Singapore

+65 6236 2486 (direct)

+65 8428 6385 (mobile)

john.bang@zurich.com.sg