The Road Ahead – Motor Insurance Redefined

Insights | Article | October 2024 | 5 min read

Continuous rapid advancements in automobile technologies are impacting both what and how we drive, and how we consume transport options in general. Growth rates for electric vehicle (EV) sales in many countries are outpacing those of internal combustion engine (ICE) vehicles as the number of EV manufacturers and models increases and EVs become more affordable. Advancements in mobile connectivity have enabled the collection of real-time telematic data on vehicle usage and driving habits, and ‘vehicle as a platform’ innovations are bringing us closer to the widespread use of autonomous vehicles.

These technological advancements are driving the need for insurance solutions that more accurately reflect changing vehicle types, usage patterns, and risk profiles. Insurance options that are tailored to address automotive technology advancements hold great promise for delivering benefits in the form of cost savings and convenience to customers. The changing technological landscape also provides a window of opportunity for stakeholders across the value chain to offer more relevant products

The EV transition is creating both needs and opportunities for new insurance services

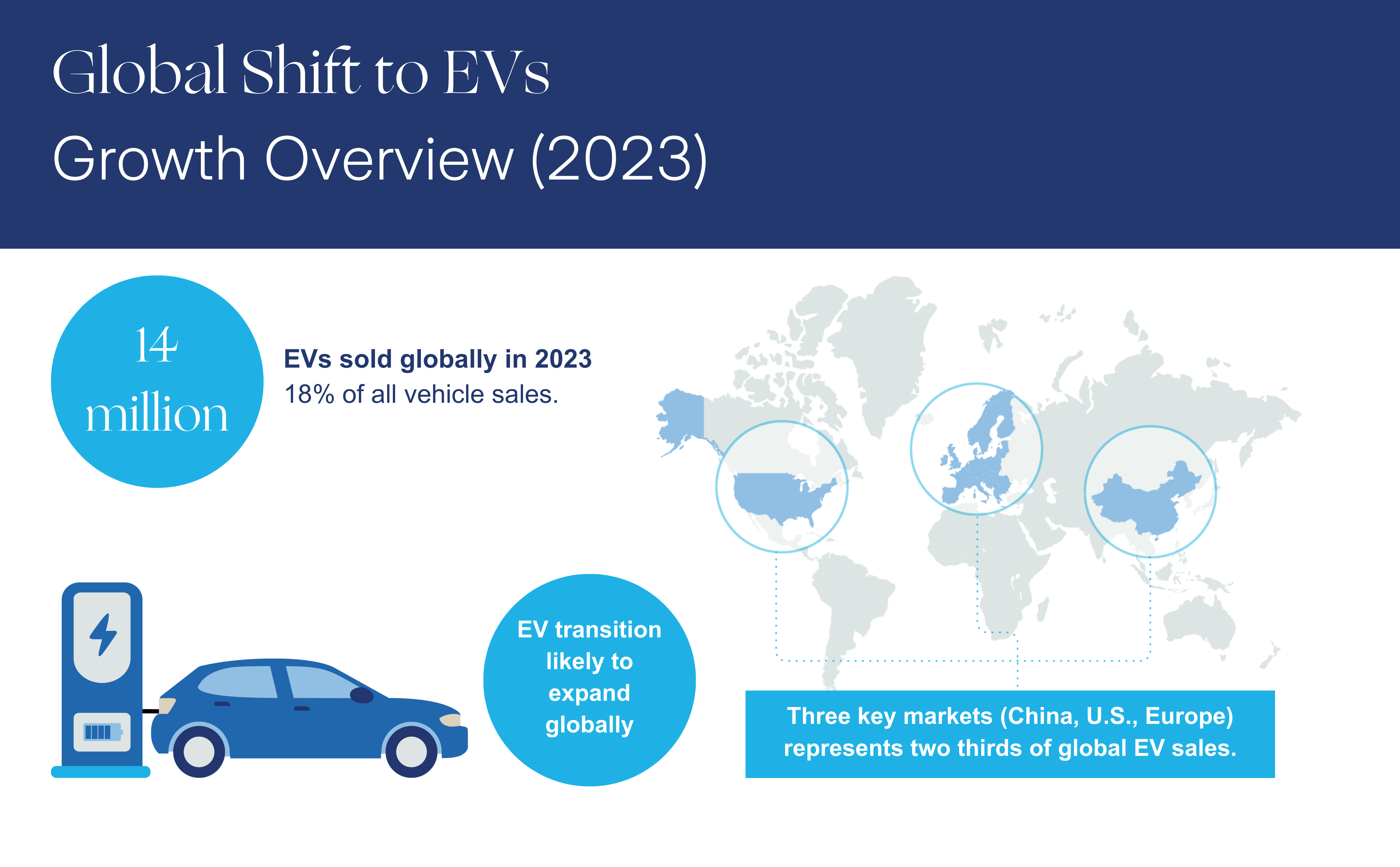

Despite recent headlines that growth may be moderating, the shift from ICE vehicles to EVs continues. Global registrations of EVs reached 14 million units, or 18% of total worldwide vehicle sales in 2023. While a large percentage of EV purchases continue to be concentrated in three major markets (China, the United States, and Europe), those three markets represent two-thirds of total global sales and stocks, meaning that the EV transition in likely to extend globally.

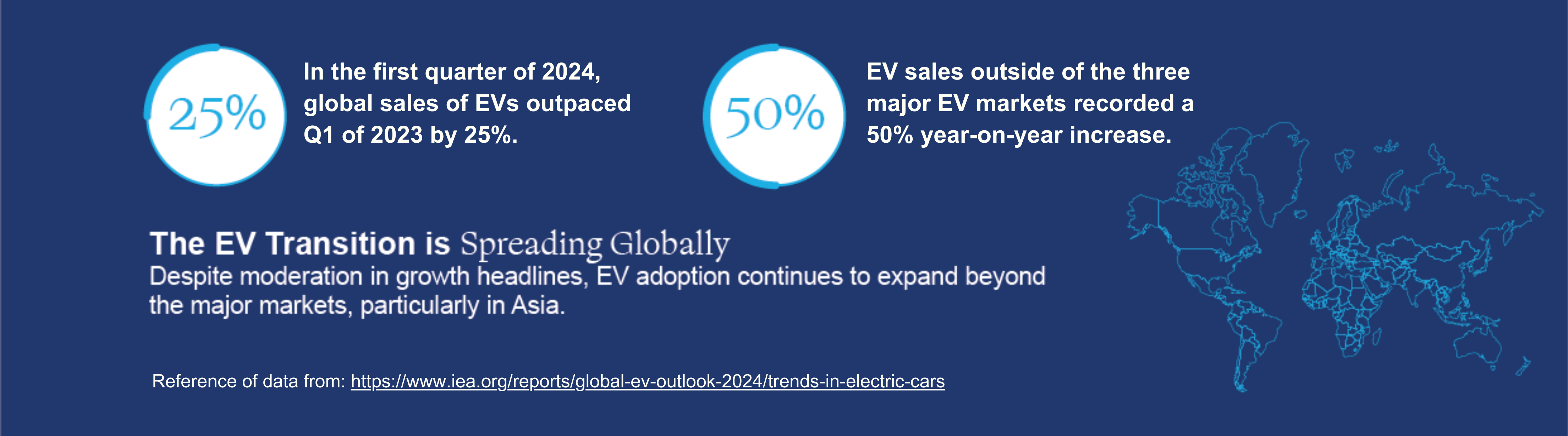

Already that extension can be seen across Asian markets. EV registrations in India increased 70% year-on-year versus a growth rate of under 10% for total car sales. In Thailand, EV registrations quadrupled year-on-year to 90,000 units, covering 10% of the local car sales share and in Malaysia total EV registrations more than tripled year-on-year, supported by tax breaks and import duty exemptions. In the first quarter of 2024, global sales of EVs outpaced Q1 of 2023 by 25%, and EV sales outside of the three major EV markets recorded a 50% year-on-year increase.

.png?h=2917&iar=0&w=2189)

In addition, as the buildout of the charging infrastructure lags in most countries (especially as EV adoption rates continue to grow), finding reliable, affordable charging locations will become an ever-more-pressing need for owners over time.

Nonetheless, as an insurer we have a unique role to play in supporting the journey to a net-zero economy by developing relevant propositions and investing in green infrastructure to support a more successful transition. Zurich is already focused on providing specialized insurance coverage, expedited claims processing, and delivering value-added convenience solutions for EV owners.

Here are some of the ways Zurich is supporting EV owners across multiple markets:

Zurich Hong Kong

Zurich Hong KongIn Hong Kong, we offer EV-specific protection that includes new-to-market benefits including coverage for damages incurred when using advanced driving assistance technologies, comprehensive owner and third-party liability for charging incidents, and an environmentally friendly battery disposal benefit.

Zurich Australia

Zurich AustraliaIn Australia, our InsureMyTesla program offers specialized insurance, designed exclusively for Tesla owners, that provides liability for damages caused by owners when charging, theft of charging cables and accessories, excess-free windscreen, and simplified claims submission through a dedicated portal on the Tesla app available 24/7.

Zurich Switzerland

Zurich SwitzerlandWith our Z Volt app, anyone in Switzerland (whether insured with Zurich or not) can easily locate a charging station from among the 10,000 in Switzerland and 300,000 across Europe and enjoy in-app payment and low-cost, fixed pricing at 3,700 Z Volt partner charging locations.

Zurich Malaysia

Zurich MalaysiaIn Malaysia, we’ve partnered with Gentari Green Mobility Sdn Bhd to expand the country’s charging infrastructure footprint by installing green mobility charging stations at Zurich’s premises nationwide.

The impact of telematic data and artificial intelligence (AI)

As more and more vehicles with embedded connected wireless technologies are sold, large volumes of high-quality passive data can be collected by external entities on usage patterns and behaviours that extend far beyond the mileage and GPS data that is commonly collected today. This telematic data will dramatically aid insurers in assessing liability for claims, for example, in cases where proof of vehicle speed is a key determinant of liability for damages incurred, or for aiding in the recovery of stolen vehicles.

It will also provide opportunities for bespoke insurance solutions that better fit driver risk profiles and usage patterns and align with customer preferences while saving them money. Zurich has pioneered a number of new solutions based on telematic data and artificial intelligence:

- Our Z Miles proposition in Malaysia includes a base premium for third-party liability and a variable premium that is charged on a pay-as-you-use basis at a rate based on the driver’s risk profile. This ensures that less frequent drivers don’t over-pay for their insurance coverage.

- In Japan, we are providing drivers the opportunity to track their vehicle’s carbon footprint through a simple online calculator and then offset that footprint by purchasing carbon credits. Zurich Japan then matches the offsets by donating to reforestation projects aligned with the UN Sustainable Development Goals (SDGs), and run by local governments, NPOs and other organizations in Japan.

- We’ve eliminated the time-consuming, manual vehicle assessment process in Indonesia by partnering with visual inspection company, CamCom Technology Pvt Ltd, to offer AI-assisted visual inspection of vehicles for insurance policy application purposes.

Customer Experience will be key for new buyers

As the market develops, the adoption of EVs and technology-enabled vehicles will accelerate. In developed markets, between 70%-80% of buyers purchase their vehicles exclusively from used car markets, and younger buyers (Gen Y/Gen Z) are far more likely to consider EV adoption (75%) than Baby Boomer generation buyers (30%). Customizing insurance offerings to align with the ‘green’ expectations of these new buyers, from specialized EV coverage to pay-as-you drive options, to offering carbon-offset options is critical. So too is providing the fully digital application and claims processes that will ensure the customer experience that digital natives have come to expect.

Partnering with Zurich Edge

Zurich Edge is a leader in motor insurance innovation, setting new standards for customer-centric products and services globally. We can create flexible offerings that marry the technological innovation coming out of the automobile industry with the buyer use cases and coverage needs for that innovation. When delivered as part of an end-to-end digital customer journey, our solutions allow OEMS and adjacent auto industry players the opportunity differentiate and enhance existing product and service offerings.

We have dedicated in-market product development teams that work collaboratively to understand your goals and objectives, and then develop customer-centric auto insurance solutions that help generate customer interest and expand customer loyalty. We are tech-agnostic, have our own open architecture and full stack technology platform, and are experts in solution development, platform integration, and creating seamless customer journeys.

To learn more about how Zurich Edge can help you increase customer interest and loyalty through the inclusion of auto insurance solutions contact/visit: www.zurich.com.sg/zurich-edge